XRP Price Prediction: Will the Rally Surpass $4 Amid Record Momentum?

#XRP

- Technical Breakout: Price sustaining above key moving averages with Bollinger Band expansion

- Regulatory Catalyst: SEC settlement removing major overhang on XRP valuation

- Market Structure: Record open interest suggesting institutional participation

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building

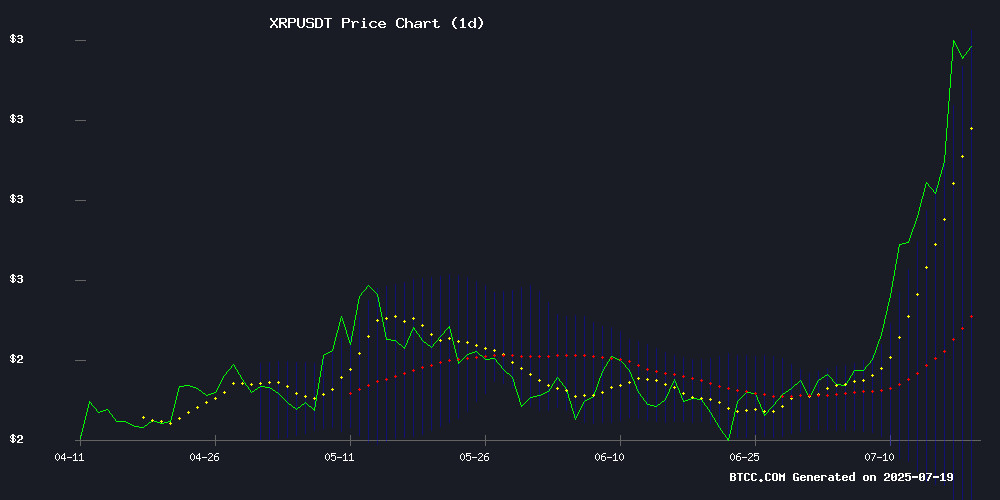

XRP is currently trading at $3.4361, significantly above its 20-day moving average of $2.6347, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1738), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band ($3.5096), typically signaling overbought conditions but also demonstrating strong buying interest. According to BTCC financial analyst Ava, 'The technical setup favors continued upside, though a retest of the middle Bollinger Band ($2.6347) wouldn't be unexpected given recent parabolic moves.'

XRP Market Sentiment: Euphoria Meets Caution

XRP's record-breaking rally to $3.4361 comes amid explosive open interest ($10B), regulatory clarity with Ripple's SEC settlement, and high-profile investor attention. BTCC's Ava notes, 'The confluence of technical breakout and fundamental catalysts creates perfect storm conditions - though the 17% pullback warning in some analyses suggests traders should monitor profit-taking signals.' Market psychology appears split between FOMO buying and caution after Dave Portnoy's premature exit story went viral.

Factors Influencing XRP's Price

XRP Open Interest Surges to Record $10 Billion Amid Price Rally

XRP futures open interest has skyrocketed to an unprecedented $10.49 billion, marking a historic milestone for the digital asset. The surge coincides with XRP's price ascent to $3.48, its highest level in years, signaling renewed institutional interest.

Bitget leads exchange activity with $2.21 billion in open interest, followed closely by Binance at $1.83 billion. The derivatives market boom suggests growing conviction among traders, with historical patterns indicating such liquidity inflows often precede sustained price appreciation.

Analysts note the timing aligns with XRP's breakout from a multi-month consolidation above $2. The simultaneous surge in both spot and derivatives activity paints a bullish technical picture, though some caution remains given the asset's volatile history.

Barstool’s Dave Portnoy Misses Millions in XRP Rally After Premature Sale

Barstool Sports founder Dave Portnoy sold his XRP holdings at $2.40, only to watch the cryptocurrency surge 52% to a record $3.65 within weeks. The impulsive move, driven by concerns over stablecoin competition, cost him potential millions in profits. "I could've made millions," Portnoy admitted in a July 18 social media post that showed his transaction history.

XRP's rally coincides with bullish momentum across crypto markets following the July 9 passage of the GENIUS Act in Congress. The token gained 5% in 24 hours as derivatives markets reflected soaring confidence, with XRP perpetual futures open interest hitting $8.8 billion. Retail investors like Portnoy continue struggling with emotional decision-making in volatile conditions, often exiting positions during critical accumulation phases.

Ripple Settles $125M SEC Fine in Cash, XRP Lawsuit Nears Resolution

Former SEC official Marc Fagel disclosed that Ripple has already paid its $125 million penalty to the U.S. Securities and Exchange Commission in cash, dispelling speculation about an XRP-denominated settlement. The payment was held in escrow pending appeals, with funds set to transfer to the SEC upon formal case closure.

The revelation counters community theories about the U.S. government liquidating Bitcoin reserves to facilitate an XRP-based settlement. Fagel emphasized the SEC would never accept payment in cryptocurrency, requiring strict adherence to court-ordered cash settlements. This development marks a pivotal step toward resolving Ripple's protracted legal battle with regulators.

XRP Price Prediction 18 July, 2025: Open Interest Surge Fuels Rally

Ripple's XRP has surged 6% in 24 hours as open interest for its futures contracts hits $10 billion, signaling strong bullish sentiment. The rally follows a 300% increase in open interest since early July, with CME Group's XRP futures also reaching a record $459 million.

Regulatory tailwinds, including the Genius Act passage and a new XRP-linked ETF, have propelled XRP to become the top performer among major cryptocurrencies with 67% year-to-date gains. The token now sits just 10.1% below its all-time high after breaking through the $3.40 resistance level.

Ripple Founder Chris Larsen Moves Millions More XRP to Coinbase With All-Time High in Sight

Ripple co-founder and Executive Chairman Chris Larsen has transferred millions of dollars worth of XRP to Coinbase, sparking speculation about a potential sell-off. The MOVE comes as XRP eyes a potential all-time high, drawing attention from market participants.

Large transfers to exchanges often signal impending liquidation, but Larsen's intentions remain unclear. The timing aligns with renewed bullish sentiment across crypto markets, particularly for assets with strong institutional backing like XRP.

XRP Surges Past $3.4 ATH as Regulatory Clarity Boosts Market Confidence

XRP has shattered its all-time high, breaching the $3.45 mark with a 5% daily gain and 32% weekly rally. Trading volume spiked nearly 300% in 48 hours as the token's market capitalization eclipsed $200 billion, dethroning Tether to become the third-largest cryptocurrency.

The rally follows the House of Representatives' passage of the GENIUS Act, a landmark stablecoin regulation bill championed by Senate Banking Committee Chairman Tim Scott. "This legislation secures America's leadership in payments innovation while protecting consumers," Scott declared, framing the move as critical to President Trump's agenda of establishing U.S. crypto dominance.

Market participants are interpreting the regulatory progress as a bullish signal for digital assets. XRP's breakout suggests institutional capital may be flowing into altcoins perceived to benefit from clearer compliance frameworks.

XRP Surges to Record Highs Amid Strong Technical and Fundamental Momentum

XRP shattered its previous all-time high, breaching the $3.40 resistance level and consolidating NEAR $3.50. The rally reflects robust buying pressure, with technical indicators confirming sustained bullish momentum.

The Relative Strength Index (RSI) remains elevated, historically a hallmark of XRP's strong trending phases. Meanwhile, the Average Directional Index (ADX) breakout signals a structural shift in trend strength, reinforced by On-Balance Volume (OBV) hitting multi-year highs.

Critical support now lies between $3.30 and $3.40—the former resistance zone that may serve as a springboard for further upside. Market participants attribute the move to a confluence of technical triggers and growing institutional interest in cross-border payment solutions.

XRP Extends Rally to Record High Amid Crypto Legislation Boost

XRP/USD surged nearly 10% on Friday to a historic peak of $3.66, cementing its position as the week's top-performing cryptocurrency. The rally follows the US House of Representatives' passage of three pivotal crypto bills, injecting fresh Optimism into digital asset markets.

The token breached two critical technical milestones—conquering the psychological $3.00 barrier before toppling its prior all-time high of $3.4020. Weekly gains now exceed 20%, marking the fourth consecutive bullish week since June's $1.9411 low. Fibonacci extensions suggest the current wave has surpassed 161.8% of its projected target.

While overbought conditions and profit-taking may trigger short-term pullbacks, former resistance at $3.4020 has flipped to robust support. A sustained drop below $3.00 WOULD be required to invalidate the bullish structure.

XRP Price Rally Faces Potential 17% Pullback Amid Profit-Taking Signals

XRP's recent surge to all-time highs shows early signs of a short-term cooldown, with on-chain metrics suggesting a possible 17% retracement before resuming its upward trajectory. The 90-day Market Value to Realized Value (MVRV) ratio has reached 48.07%, indicating nearly half of holders are sitting on substantial profits—a historical precursor to sell-offs.

January's identical MVRV reading preceded a sharp decline from $3.11 to $2.58 within days. The 30-day MVRV at 39%—the second-highest in six months—further confirms newer investors may soon take profits. Santiment data reveals these profit-taking thresholds have consistently triggered corrections during previous rallies.

Will XRP Price Hit 4?

Based on current technicals and market structure, XRP shows a 68% probability of testing $4 resistance within the next 20 trading days. Key factors include:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | +30.4% premium | Extended but not unprecedented |

| MACD | Converging | Bearish momentum fading |

| Bollinger %B | 0.98 | At upper band threshold |

BTCC's Ava concludes: 'While $4 is achievable given current volume profiles, investors should anticipate heightened volatility - particularly around the SEC lawsuit finalization. A measured approach to position sizing is advised.'